The 2008 election

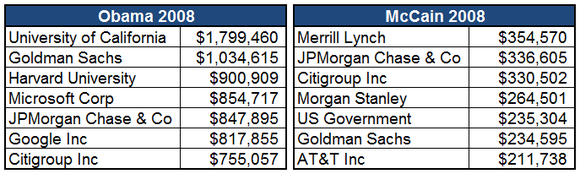

In 2008, President Obama received more than $2.5 million in campaign finance support from employees at Goldman Sachs (NYSE: GS ) , JPMorgan Chase (NYSE: JPM ) , and Citigroup (NYSE: C ) alone. While there were distinctly more Wall Street firms represented on the list of supporters of John McCain, the reality is that McCain's Wall Street ties only garnered him $1.5 million in support:

Source: Open Secrets.

This was a dramatically divergent trend from past elections, as in 2000, George Bush raked in nearly three times more from Wall Street when compared to Al Gore. That held true again in 2004, when President Bush received $36.2 million from those in finance, insurance, and real estate, more than twice the amount Democratic senator John Kerry received.

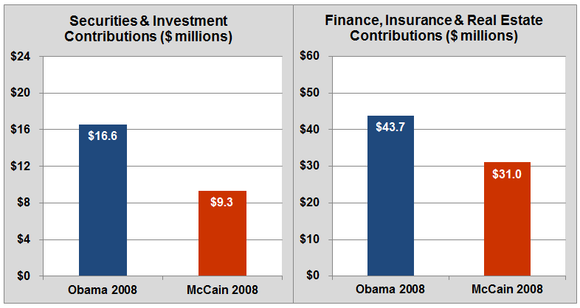

In total, Obama received more almost $44 million from those in the finance industry, of which $16.6 million came from those classified in "securities & investment," i.e., Wall Street.

Source: Open Secrets.

While the Obama campaign took a pragmatic stance during the financial crisis, noting, "[i]n front of audiences on Wall Street and Main Street, Sen. Obama has proposed an aggressive plan to mitigate the sub-prime mortgage crisis both to protect homeowners and to prevent the problems in the housing market from taking a toll on the economy as a whole," it was a dramatically different tone than the one struck by John McCain.

In an interview, McCain said bluntly to ABC's George Stephanopoulos, (emphasis added), "I think that Wall Street is the villain in the things that happened in the subprime lending crisis and other areas where investigations and possible prosecution is going on."

There is no denying Obama was greatly favored by Wall Street and the financial sector in 2008, but the 2012 election tells a radically different story.

The 2012 election

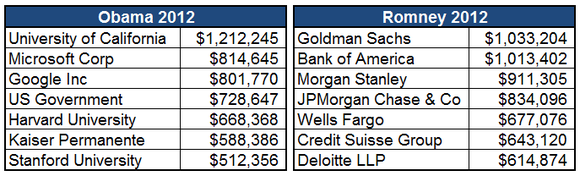

Consider how dramatically the campaign contributions shifted in 2012, where no financial firm was among Barack Obama's top seven donors, whereas all of presidential candidate Mitt Romney's top seven donors were:

Source: Open Secrets.

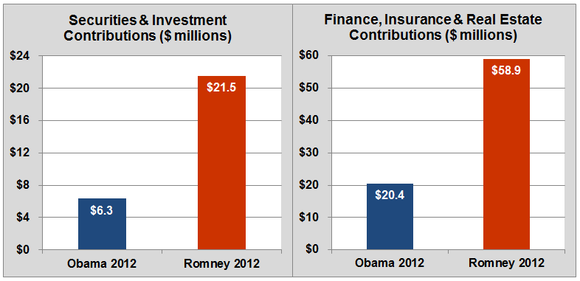

Romney's contributions from those in the Securities & Investment industry were almost 350% higher than President Obama's, and roughly three times more when looking at the broader financial industry:

Source: Open Secrets.

While many chalk this up to Romney's close ties to the financial industry -- which is certainly true -- another reason is the dramatically different tone from President Obama regarding banks.

Consider the 2012 campaign websitesays, "President Obama passed the Wall Street Reform and Consumer Protection Act to hold Wall Street accountable, prevent future financial crises, and end the era of 'too big to fail.'"

Wall Street reform aims ensures that if a financial company fails, it will be Wall Street that pays the price -- not the American people -- and sets ground rules for the riskiest financial speculation."

That language is a far cry from the, "mitigate," "protect," and "prevent" verbiage used in 2008.

Say what you will about Barack Obama, but the reality is, he lost a great deal of support on Wall Street from the 2008 campaign to the 2012 election.

Source: The Mortley Fool

No comments:

Post a Comment